|

NEW DEVELOPMENTS IN MIDDLE EAST EXPLORATION AND PRODUCTION.

Pete

Jeans Shell International E&P BV, Postbus 60, 2280 AB Rijswijk, The Netherlands

(Now

working as Independent Consultant)

Abstract

:

Little

or nothing in the way of significant new plays has emerged in the Middle East

since Saudi Aramco's huge Hawiyah Upper Palaeozoic gas discovery (which, with

follow-up success, has added ~30 trillion cubic feet (tcf) reserves in the last

5-6 years) and Petroleum Development Oman (PDO)'s Lower Palaeozoic gas play

(~25 tcf) in the early 1990s, and PDO's Infra-Cambrian Ara carbonate stringer

play in the late1990s (STOIIP >2 billion barrels (BBO), but only ~300 million

barrels (mmbo) added to reserves to date).

Active

Middle East exploration is currently strongest, and most successful, in those

countries where International Oil Companies (IOCs) are welcomed; where terms

and conditions have been relaxed; and where Production Sharing Contracts (PSCs),

or similar, are the norm. With these exceptions, and with Iraq still off-limits,

exploration has been limited by the fact that progress towards win:win relationships

between IOCs and Major Resource Holder (MRH) Governments has proved generally

intractable whilst in Iran the framework of buyback contracts - arguably acceptable

for lower-risk Development projects - has been largely unacceptable for higher-risk

Exploration projects.

In

addition, Middle East OPEC nations are focusing their efforts on major investments

in capacity-enhancing secondary recovery and gas utilization projects, rather

than on exploration: indeed, levels of exploration in Middle East OPEC states

are amongst the lowest in the world - arguably reflecting the buffer provided

by their huge reserves.

In

this paper, I will look firstly at the exploration history of the Middle East,

from antiquity to the present-day; then move to the broader upstream picture;

and finally review the Middle East upstream in a global context. Note that in

the text that follows, much of the information comes from confidential or proprietary

sources, and so conventional references may not be given.

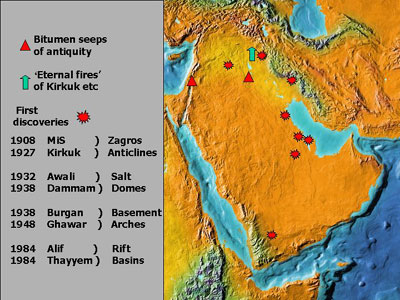

Middle

East Hydrocarbon Exploration History (Fig 1)

Hydrocarbons

have been known, utilized, and even revered, in the Middle East since the mists

of antiquity, as evidenced by the asphalt seeps of the Dead Sea and Palestine,

and of Abu Jir in Mesopotamia, and by the 'eternal fires' of the Kirkuk region.

Modern hydrocarbon exploration commenced around the turn of the last century,

and found its first success in 1908 at Masjid-i-Suleiman in the Iranian Zagros

foothills. In the next 75 years, all major discoveries fell into one of three

structural settings or trap types, namely Zagros folds, salt domes or salt pillows,

and basement-cored arches. This is true both as regards early exploration, where

the emphasis was on surface structures (as shown on Fig. 1), and in post-WWII

exploration where the focus was increasingly on subsurface structures delineated

by seismic. Only in 1984 was an additional structural setting and trap type

(that of the Rift Basin) proven to be commercially petroliferous, with the discovery

of Alif and Thayyem fields, in the Marib and Euphrates Graben respectively.

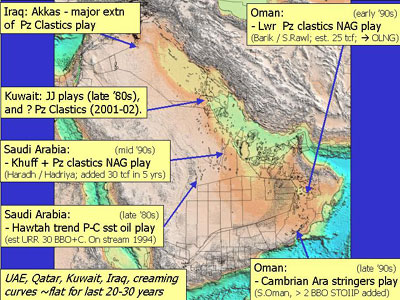

Major

Plays of the Middle East (Fig.2)

Significant

hydrocarbon plays in the last two decades in the Middle East have been few,

and they have been dominated by Oman and Saudi Arabia. In Oman, the Huqf-sourced

Lower Palaeozoic non-associated gas play, centred on the Ghaba Salt Basin, has

proved ~25 tcf of gas reserves, which laid the foundation for the Oman Liquified

Natural Gas (LNG) scheme. The principal reservoirs are the Ordovician Barik

and Miqrat sands, located below the existing Permo-Carboniferous Haushi oil

fields of the Ghaba area, discovered in the 1970s. These deep targets only became

visible on the then newly-acquired long-offset 2D and 3D seismic data. Recent

exploration has extended the play to the northwest (onto the Central Oman -

Makarem High) and into the northeasterly continuation of the salt basin in the

Kauther area. Further south in Oman, and slightly later (late 1990s vs early

1990s), the Infra-Cambrian to Cambrian Ara Stringer play started to be proved

commercially viable, driven by new drilling and completion technology and high

quality 3D seismic. The play comprises self-sourcing Ara carbonate slabs floating

in and sealed by Ara salt. In place volumes are huge (well over 2 BBO), but

conservative reserve booking, reflecting the complexity and high Unit Technical

Cost (by Middle East standards) means that reserves currently total ~300 MMBO.

In Saudi Arabia, by contrast, the two major plays of the late 1980s - mid 1990s

have been sourced from Silurian 'hot' shales of the Qusaybah Formation. Successive

discoveries of light oil in Permian Unayzah sands, draped over basement horsts

in the Hawtah trend, southeast of Riyadh, on the western flank of the Rub'al

Khali basin, have contributed ~30 BBO to Saudi Aramco's reserves, whilst deep

exploration on and around the super-giant Ghawar field has lead to the discovery

of over 30 tcf of non-associated gas in Khuff carbonate and Palaeozoic clastic

reservoirs, above or on the flanks of basement horsts. Elsewhere in the Middle

East, exploration of the deep Jurassic play in Kuwait by KOC has proved successful

in the highly-pressure, fractured limestones of the Najmah-Sargelu sequence,

and also in the deeper Marrat grainstone shoals. Recoverable volumes, though

significant, are not yet thought to have reached the multi-billion barrel class.

Most recently, the results of NW Raudhatain-1 well suggest the emergence of

a potential Palaeozoic clastic play in Kuwait may be heralded. The Akkas discovery

in Western Iraq, close to the Syrian border (comprising ~100 mmbo in a Silurian

sand and ~7.5 tcf of gas in underlying Ordovician sands) represents a significant

extension of the Silurian-sourced Palaeozoic clastics play. Finally, it is ironic

that the largest discovery in the Middle East during this period (Azadeghan,

with well over 10 BBO reserves) does not qualify here because it is not a new

play - merely another large, gentle anticline sitting in the Zagros foreland

basin, outboard of the Dezful Embayment in Iran.

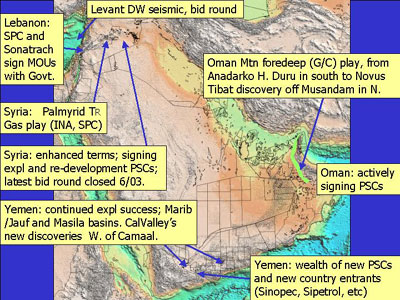

More

Recent Exploration Activity: periphery of the Arabian Plate (Fig. 3)

Exploration

on the periphery of the Arabian Plate is thriving, driven by the presence of

the IOCs, who are, in turn, attracted by the prevalence of PSCs, with their

attractive risk:reward structure. Pre-eminent in this class are Syria (especially

the Palmyrid gas play), Oman (activity throughout the country, but especially

in the foredeep of the Oman Mountains), and Yemen (primarily in the Masila Basin

in central Yemen, but new production also proved in the S1 and Auqban blocks).

Success rates in all these areas are high - attributed to modern, high-quality,

seismic acquisition and processing.

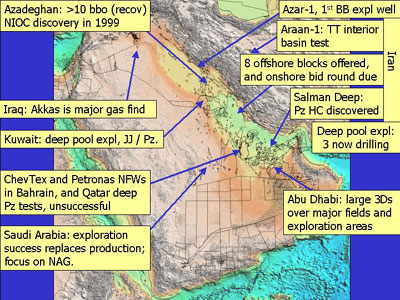

More

Recent Exploration Activity: the core MRHs (Fig. 4)

By

contrast, the core MRHs of the Middle East are characterised by National Oil

Company (NOC) exclusivity, or by provision of access to IOCs only through the

medium of Buyback or Service-type Contracts; by a focus on deeper-pool exploration

and appraisal; and by levels of exploration which are much lower than in the

periphery of the Peninsula. The sole exception to this last statement is Iran,

where NIOC is very active - striving to reverse long-term decline in existing

fields, and focussing on deeper pool and outstep tests. However, only 2 IOCs

are currently drilling in Iran (soon to be joined by a third), all exploring

under Buyback contracts. Saudi Aramco and Kuwait Oil Company continue to be

successful. The key observation, however, is the unattractiveness of Buyback

and Service-type contracts, especially for exploration: the contractual framework

offers minimum upside to the IOCs in the event of success, and hence no balance

of risk and reward. Indeed, Buybacks have been described as "all stick and no

carrot".

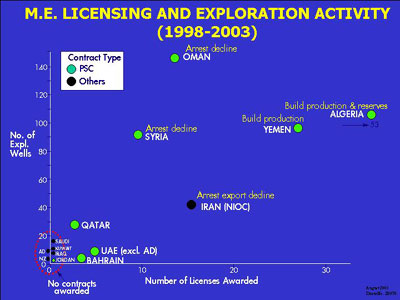

The

benefit of PSCs to both host Governments and IOCs is illustrated by Fig. 5:

high

levels of license uptake and exploration drilling are the exclusive preserve

of PSC-awarding countries. Even though these PSC terms are 'harsh' by global

standards (IHSE, 2002), the access to upside still provides a sufficient incentive

for many IOCs.

The

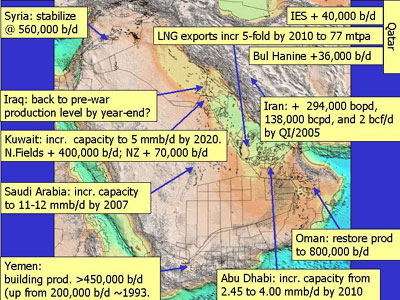

Core MRHs are building Production Capacity (Fig. 6)

Moving

to the broader E and P, Upstream, arena, it is apparent that the Middle East

MRHs are focussed on building oil production capacity and (in the case of Iran)

actual oil production. There are two principal challenges, namely - the large

tank reservoirs in the super-giant fields like Burgan, Ahwaz, and even Ghawar

are becoming seriously depleted, and operators are now targeting bypassed oil

and more heterolithic reservoirs, whilst gas and water cuts are increasing -

all factors which lead to an increase in Unit Technical Cost (UTC). - the dramatic

increases in domestic oil consumption will make the task of maintaining export

volumes increasingly difficult, especially for Iran, and not least because OPEC

quotas are based on total production, not exports alone.

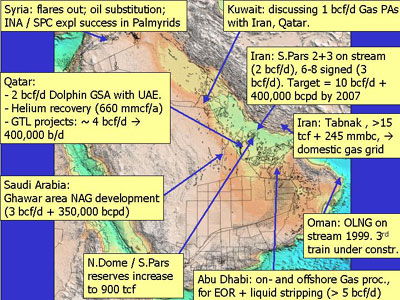

A

Shift to Gas (Fig. 7)

Throughout

the Middle East, a significant shift to gas production and consumption is apparent,

with major investment focussing on three prime areas - Domestic substitution

of oil by gas (to free up oil for export) - Enhanced oil recovery, via gas injection

- Export, either in the form of LNG, or as products from Gas To Liquids conversion

(GTL), or by pipeline. Domestic substitution is the driver behind Saudi Arabia's

Natural Gas Initiative, which will see the first entry of IOCs (Shell and Total)

into Saudi Arabia since the nationalization of Aramco in 1980 (Fig. 8).

LNG

export capacity expansion is dominated by Qatar and Iran, on the back of the

~900 tcf gas reserves in the Khuff North Dome - South Pars accumulation. Qatar

is reported to be planning to increase LNG capacity from a current 14 million

tonnes p.a. to 77 million tonnes p.a. by 2010, but this expansion, and that

similarly planned by Iran, will not be straightforward. Significant competition

for key markets in the Atlantic Basin will come from Nigeria, Venezuela, and

Trinidad; in the Far East competition will come from Indonesia, Sakhalin and

the NW Shelf of Australia; whilst the W-E pipeline will pre-empt potential LNG

imports to the eastern seaboard of China. A focus on pipelines is relatively

new, but significant, with supply hubs developing in Egypt (gas to Israel, Jordan,

and Lebanon), Qatar (gas to Dubai via the Dolphin project; gas to Kuwait under

discussion), and Oman (gas to Fujairah). These projects together with the north-south

gas pipeline in Iraq (when completed) have the potential to form the 'seed'

for a Middle East-wide gas pipeline network. One negative side-effect of the

dramatic increase in gas production will be the concomitant increase in condensate

and Natural Gas Liquids (NGLs) hitting the market. Current Middle East condensate

and NGL production (excluded from OPEC quotas) is ~3.5 mmb/d, and these, OPEC-generated,

volumes are contributing to the erosion of OPEC's share of world crude markets

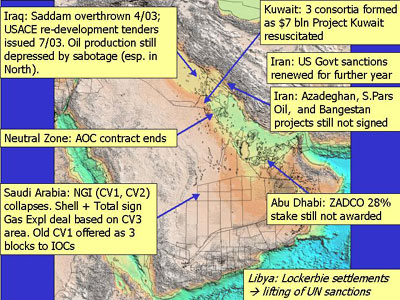

(see below). Recent Events and their Implications Recent events (Fig. 8) firstly

highlight the difficulty of concluding win:win deals in MRH countries (Saudi

Arabia, Kuwait, Iran, UAE: Qatar alone has been successful in attracting multiple

inward investment deals). However, pressure from external events means that

attitudes will surely need to change if Middle East MRHs are not to be left

behind in the race to attract investment funds: Iraq will open up; UN sanctions

have recently been lifted on Libya (a PSC country); whilst capital investment

requirements of the Deep Water arena (again dominantly PSC terrain) are estimated

at $15 billion p.a. for the next 3 years. Secondly, recent events also highlight

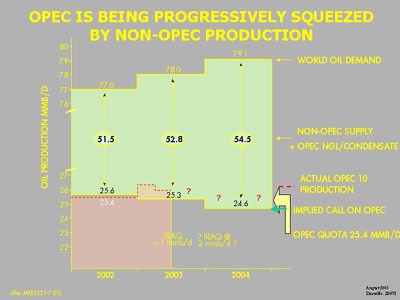

just how dramatically OPEC 10 (i.e. OPEC without Iraq) oil production is being

squeezed (Fig. 9) by a combination of burgeoning non-OPEC oil production and

weak increases in global oil demand.

Non-OPEC

supply is slated to increase by 1.2-1.4 mmb/d p.a. driven especially by Russia,

the CIS, and Deep Water (notably West Africa). World oil demand is increasing

annually by only ~1.0 mmb/d. On top of this, by 2004, Iraq is expected to bring

an average of 1.5-2.0 mmb/d to the market. In September 2003, OPEC acted and

reduced the OPEC 10 quota from 25.4 mmb/d to 24.5 mmb/d, effectively choosing

to maintain oil prices at the high end of the OPEC target range ($22-28/bbl)

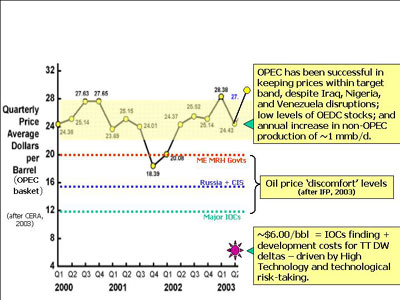

rather than compete for market share. Indeed OPEC's ability to compete for market

share by opening the taps and prompting a freefall in oil price is weakening:

Fig. 10 shows that OPEC's desire to maintain high oil prices is driven by its

high oil price 'discomfort zone' - i.e. the oil price required to keep national

budgets out of deficit.

Also

shown on Fig. 10 are the comparative, significantly lower, 'discomfort levels'

of Russia/CIS and major IOCs, and also the Finding and Development costs for

Tertiary Delta Deep Water oilfields - now ~$6/bbl, or roughly half of what they

were 20 years ago.

This

illustrates the downside for MRHs of a high oil price: it encourages the development

and utilization of high technology to enable production of the marginal barrel,

notably in Deep Water, but arguably most dramatically in the Athabaska Tar Sands

(Fig. 11) where 180 BBO are now deemed economically viable by the EIA at a Unit

Cost of ~$12/bbl - resulting in the first ever significant drop in OPEC's share

of world oil reserves (from 65% to 56%).

This,

for me, is the most significant development in the Middle East oil patch in

recent years

Conclusions

The

principle conclusions of this review are :

- there have been no significant new plays in the Middle East in the last 10

years or so,

- exploration on the periphery of the Arabian Plate is thriving

-

driven by the presence of PSCs, and hence IOCs,

- exploration in the core MRHs is more limited, focussing on 3D-seismic

-lead deeper pool exploration,

- the core MRHs are focussing on building production capacity through field

re-development,

- there is a major focus throughout the region on gas

- for domestic fuel substitution, enhanced oil recovery, and export (as LNG,

GTL, or by pipeline),

- there is a dilemma facing the Middle East MRHs (the OPEC 10), namely how to

balance the conflicting needs for market share and high oil price in the face

of burgeoning non-OPEC production.

Text

Figures and Captions Author notes: Pete Jeans worked for Shell for 30 years.

From 2001-2003, he held the position of Regional Geological Consultant for the

Middle East region in Rijswijk. Pete has a Ph.D in Geology from Birmingham University,

England; is a member of the AAPG; a Fellow of the Geological Society; and is

on the Editorial Board of GeoArabia.

|